Bitcoin hits 2023 high. What will happen to cryptocurrencies in December

Our experts analyzed the state of the market and talked about how bitcoin will behave in December 2023

In November, bitcoin rose by 11% against the dollar. The main driver of the upward dynamics was positive expectations of the soon approval of the spot bitcoin-ETF by the US financial regulator. Additional support for the crypto market was provided by the weakening of the dollar. And the growth of stock indices in the U.S. in anticipation of the U.S. Federal Reserve rate at the U.S. Federal Reserve meeting on December 13.

In the market remains positive mood of market participants. The technical picture on the daily timeframe is also favorable for the continuation of the upward movement of the pair BTC/USD in the medium term before halving.

Halving is a planned reduction in the number of newly issued bitcoins (BTC). Which are created and distributed to miners who perform verification and validation of transactions on the network. This is embedded in the bitcoin program code to ensure that the total number of coins on the network never exceeds 21 million units. The next bitcoin halving is expected in April 2024.

Important events that the markets will focus on include U.S. gross domestic product (GDP) growth data for the last quarter and personal consumption expenditure (PCE) price information for the third quarter. The market is actively watching inflation as it is linked to expectations of further decisions by the Federal Reserve (Fed).

We expect bullish dynamics

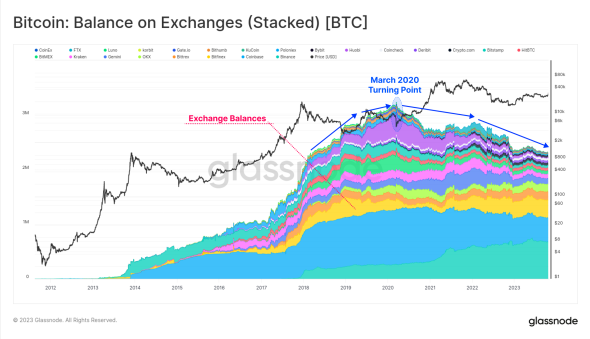

The digital asset market has historically tended to rise in December. Given fundamental factors. Such as the prospect of spot bitcoin ETF approvals in early 2024. And the approaching halving, the growing number of institutional investors and the sustainability of market capitalization. Our experts expect bullish momentum in December. As they did throughout the fourth quarter before that.

Our expectations for November were to reach the level of $38 thousand, and bitcoin succeeded to grow to this level at the end of the month. Because of this, the $40-45k zone expected since the beginning of the year remains the target zone for December. And our experts expect BTC to grow to these levels, as well as to increase the capitalization of the entire cryptocurrency market to $1.6-1.8 trillion.

Now the main resistance level for bitcoin is around $40 thousand. It can be expected that the cryptocurrency will overcome this psychological mark by mid-December. The optimistic scenario assumes bitcoin growth to $45 thousand by the end of the year and continued growth at a quiet pace to $55 thousand until halving in the bitcoin network in the spring of 2024.